Introduction

As another year draws to a close, we are happy to report a strong investment environment, and we look forward to opportunities in the new year. Below we will cover important trends we are watching and then turn to brief updates on market dynamics that affect our flagship strategies of impact secondaries (private equity) and sustainable infrastructure.

Notable Trends and Policy Updates

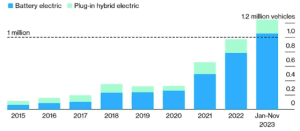

EV sales milestone. Annual electric vehicles sales in the USA just crossed the 1-million-unit threshold. EVs, combined with hybrids and plug-in hybrids, accounted for 17.7% of all new light-duty vehicle sales during Q3. For all of 2021 and 2022, such sales represented 8.5% and 12.3% of that market, respectively. The growth in recent quarters can be attributed to several factors, including increasing consumer acceptance of EVs, greater availability of charging stations, tax credits provided by the Inflation Reduction Act (IRA) and the declining sticker price of EVs due to economies of scale (average prices dropped 5% in Q3).

US All-Electric Vehicle Sales Pass the 1 Million Mark

Passenger EV sales by drivetrain

Source: BloombergNEF and Electrek

EV charging. As EVs become a greater share of the mix of cars on the road, new challenges and investment opportunities arise, especially relating to infrastructure. The grid and existing charging infrastructure is insufficient to meet the growing demand from EV drivers and more investment is needed. S&P Global Mobility estimates there were about 126,500 publicly available Level 2 (AC) charging stations (e.g., 220v systems found in parking garages and shopping centers) and 37,000 Level 3 (DC) charging stations (more powerful and can typically charge an EV from a 10-20% charge to an 80% charge in 15 minutes) in the United States in 2022. Per S&P, even when home-charging is considered, the United States will need the number of EV chargers to quadruple by 2025 and to grow more than eight-fold by 2030.

According to the DOE and in response to the growing demand, manufacturers have announced investments of over $500 million in more than 40 plants to make “Buy American-compliant” EV chargers and related equipment. These plants will be manufacturing Level 2 chargers, Level 3 chargers and wireless charging hardware, creating more than 3,000 new jobs.

Announced American-Made EV Charter Investments as of September 2023

Related opportunities. In addition to EV charging investment opportunities, we are seeing related opportunities in onsite energy storage, onsite solar, new transmission lines, load balancing technology and advertising models that focus on the captive audience of EV drivers while they are recharging.

Low solar panel prices. Solar panel prices are at the lowest point ever due to too much production capacity. According to Mercom and Bloomberg New Energy Finance, module prices have dropped 45% since last November and are at their lowest level ever, $0.128 per watt. PV magazine predicts prices will drop farther, reaching roughly $0.10 per watt by yearend 2024. The solar PV manufacturing industry is often characterized as volatile and prone to boom-and-bust conditions. Right now, we are in a period of oversupply with low/no profitability for panel makers. This is happening despite soaring demand, with 400GWs of new solar installations worldwide this year, according to our friend Gerard Reid at Alexa Capital. The low prices are of course a benefit to buyers, including our active infrastructure funds and in-house community solar development team. It should be noted that the above prices likely relate to Chinese-made panels and do not take into account any applicable U.S. tariffs and also would not qualify for “made in America” tax benefits under the IRA. So prices are low but U.S. developers have a few other factors to consider when buying panels.

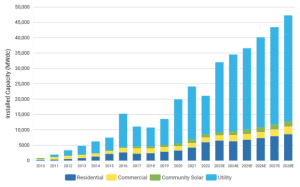

More solar power. We expect 2023 will be a record year for solar deployment in the US and for stellar growth to continue in the foreseeable future. SEIA/Wood Mackenzie are projecting steady growth across residential, commercial, community solar and utility projects through at least 2028.

US Solar PV Deployment Forecast

Source: SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight Q3 2023

Copper demand rising. Demand for copper and other raw materials is growing rapidly as the world transitions to using more wind and solar power and driving more EVs. According to the Copper Development Association, solar power systems require approximately 5.5 tons of copper per MW and wind power systems require approximately 3.9 tons per MW for onshore systems and 10.5 tons for offshore systems, where long connections to the mainland require large amounts of copper cable. Further, the average EV requires 3x more copper than an internal combustion engine car, according to Forbes. EVs, solar panels, wind turbines, new transmission lines to connect our growing number of distributed power systems, new EV charging stations and energy storage systems require copious amounts of copper and other materials too, such as steel, aluminum, nickel, cobalt, lithium and rare earth minerals. We should responsibly expand the supply of these materials, including likely mining domestically. Industry participants are starting to sound the alarm that the demand for copper and other raw materials is going to quickly outstrip projected supply, which would hamper these global transition efforts. Few new mines are being built because of regulatory burdens, environmental concerns and rising capital and labor costs for miners. Difficult policy choices are ahead. One potential bright spot is an alternative to invasive mining, which is to collect mineral nodules from the ocean floor, a process being championed by The Metals Company (a portfolio company of our Clean Growth V).

Market Update

This is such an interesting market right now with many large variables influencing it. First, the exit environment is still constrained with very few IPOs and some of the lowest levels of M&A activity we have seen in a decade. The three IPOs discussed last quarter—Arm, Instacart and Klaviyo—did not signal a re-opening of the IPO window. All have been volatile in the ensuing weeks and while Arm is up about 36%, Klaviyo is down about 9% and Instacart is down about 18%. In spite of the headwinds, our Clean Growth IV fund, had a successful IPO for Googol Tech, which priced at ¥12/share and now trades at about ¥36/share. Other than Googol Tech, we have noticed portfolio companies with IPO ambitions have pushed out the timing of their expected listing to 2025, almost in lockstep. On the M&A front, tight credit conditions and lower leverage levels kept M&A transactions muted. Looking back at the final Q3 stats, private equity exits by count and value were down 46% and 45% year-over-year, respectively, and Q4 activity to date is running at approximately the same level as the prior quarter.

Existing investors are still stuck in a liquidity crunch. They need IPO and M&A activity to accelerate so they can monetize their existing investments in private equity funds and relieve the now long-standing liquidity pressure they have been operating under since mid-2022. Many institutional LPs are still at or above their allocation limits for private equity. Meanwhile, GPs are trying to raise new funds and all but a few are finding the fundraising process much slower, longer and arduous than in prior years. There is a significant mismatch between the demand for capital from GPs and the supply of capital from institutional investors. Here is where it gets interesting for secondary investors like North Sky. Liquidity constrained investors have begun to open the relief valve; they are selling assets to secondaries funds to create the liquidity they need to continue committing capital to their favorite GPs. This is why we have been saying recently it feels like a “buyer’s market” for secondaries funds—willing sellers, ample supply and attractive pricing. The cherry on top is we are experiencing little to no competition for impact assets. According to Pitchbook, impact secondary strategies have accounted for 0.4% of impact capital raised since 2007. In comparison, secondary strategies have accounted for 3.7% of all private capital raised since 2007. In recent months, we have made new investments in the areas of healthcare, education and carbon capture & utilization.

Notwithstanding the general slowdown in exits, there have been several notable exits within our secondaries funds, including:

- GaN Systems was acquired by Infineon in October, resulting in a return that was more than 2x our expected upside underwriting case (and about 3x greater than our base case). GaN Systems is a developer of high efficiency gallium nitride semiconductor transistors.

- A consulting and engineering firm specializing in environmental, energy and infrastructure services acquired one of our portfolio companies that provides geospatial mapping services and software designed to address critical business, environmental and societal issues. This exit exceeded our upside underwriting case by more than 4x.

- EQT-backed Nijhuis Saur Industries has agreed to purchase a portfolio company of XPV I, with a closing expected in the next 45 days. The Company designs, builds and operates water recycling systems for stadiums, college campuses, corporate headquarters and similar sites.

We had another busy quarter, making progress on several fronts. Within our existing funds we were actively creating value across various renewable natural gas (RNG), waste-to-power, solar, hydro and energy storage projects. All such projects are benefiting from strong local, state and/or federal policy support, including the Inflation Reduction Act. We are happy to report the Rhode Island Bioenergy Facility, a North Sky portfolio project, injected renewable gas into its local gas pipeline for the first time in December, a milestone in the redevelopment of that site. The project will sell RNG to a large Canadian fuel company as part of that entity’s participation in Canada’s Clean Fuel Regulation.

Despite a somewhat choppy exit environment for infrastructure assets, we were able to enter into an attractive sale agreement for Alliance Fund I’s interest in Natural Systems Utility, a large water / wastewater treatment provider. The sale is subject to regulatory review (CFIUS) because the acquirer is headquartered outside the U.S. The deal is expected to close no later than February. We also positioned the biggest remaining asset within Alliance Fund II for sale. A formal process kicks off in January and based on preliminary indications of interest is expected to result in a substantial return to investors.

In early December, we attended the Southeast Renewable Energy Summit in Charlotte, NC. Key points from the conference were that solar panel and battery prices were noticeably lower than six months ago. Further, attendees generally agreed that 2023 was a terrific year for development activity but was also important due to the new federal guidance on the Inflation Reduction Act that was issued throughout the year. Important recent guidance surrounded the “made in America” requirements and the qualifying process for the low and moderate income (LMI) tax credits. Long-time readers will remember that the IRA offers tax credits for 30% of a qualifying project’s costs plus other tax credits are available if the project has certain other attributes such as using components made in America, being located in a LMI area or utilizing prevailing wages for the labor used in construction of the asset. Each of those is commonly referred to as an “adder” and one or more of them may be able to be stacked on top of the 30% tax credit, although there are limitations on stacking. The adder for LMI credits is 10-20% and the others are 10%. Now that the policy support has been further clarified, 2024 should be an even bigger year for deployment.

In mid-December, we participated in the annual Renewable Natural Gas conference in Dana Point, CA. Key takeaways from that event were (1) there will be more focus on quantifying industry-wide costs to enable more accurate tracking of that data in national databases, (2) there has been a sharp increase in utility procurement of RNG and, most importantly, (3) the Environmental Protection Agency’s newly issued volume requirements for the Renewable Fuel Standard program support 25% annual growth in RNG production for the next two years.

Looking forward, we have a limited amount of capital remaining in our third fund to put to work, likely alongside existing developer relationships in the areas of community solar, RNG and storage. We expect the first investments from SIF IV to be in those same areas, including municipal waste to energy and biosolids to energy. We believe our lower middle market strategy of partnering with experienced developers, in specific sectors where overlapping policies strengthen demand for clean resources, will continue to yield very attractive results.

Conclusion

We feel blessed to have been doing work we love for nearly 25 years. We are especially grateful to the numerous long-standing limited partners who have been investing with us across multiple funds and many years. We are equally grateful to the newcomers, including those in Canada, Brazil, Germany, UK, Netherlands and elsewhere. Welcome!

We have been central players in the impact marketplace since its inception roughly 20 years ago. In those early days, we participated in the supercycle of innovation that brought us electric cars, LED lighting, ubiquitous solar power, new battery chemistries, water purification technology, indoor agriculture, automated recycling centers (robots!), reusable rockets, deep sea exploration, Earth-scanning logistics satellites and so much more. It has been quite a ride.

As we eagerly move into the new year, we see near-term promise in renewable fuels, community solar, sustainable waste management, energy storage, EV charging, smart grid, smart meters (specifically in Germany), nutrition, recycling, heat pumps/HVAC, efficiency gains in transportation and manufacturing, water treatment, automation, artificial intelligence, education and healthcare. Farther over the horizon, we see opportunities in mobility (autonomous driving soon and then flight), green hydrogen and fusion power, among others. There are of course challenges ahead—human conflict/war, inflation, political corruption/malfeasance and environmental concerns about things like offshore wind power (whales, birds) and responsible mining of the material we need to continue the transition to EVs and renewable power (copper, nickel, rare earths, etc.). But by working together, we can resolve those problems and overcome those obstacles to make this world a better place for our children and grandchildren. Collectively, North Sky and our Limited Partners accomplished great things this year. Next year is going to be even better.

We wish you a (belated) happy Hanukkah, a very merry Christmas and a prosperous and healthy New Year!